Explore Our List Of Top 5 Budgeting Apps

Jan 17, 2024 By Triston Martin

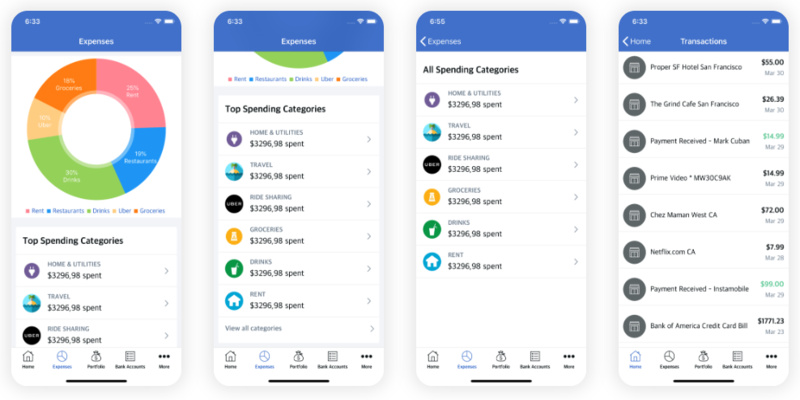

Are you ready to revolutionize your financial journey and take control of your money? Discover the power of cutting-edge and best budgeting apps designed to transform how you manage your finances. From intuitive interfaces to game-changing features, these apps are your ticket to a brighter financial future.

The best free budgeting apps are revolutionizing personal finance management by providing users with individualized analysis, real-time insights, and intuitive interfaces. Budgeting applications pave the path to financial success by promoting responsible spending, motivating savings, and offering useful advice.

Keep reading to explore more!

Discover The Best Apps For Budgeting or Financing

1) Mint: Your Financial Companion

Leading budgeting app, Mint, transforms money management by giving users instant access to information about their spending habits. Since being acquired by Intuitive, Mint has provided a comprehensive financial picture by smoothly connecting investments, bank accounts, and credit cards. In addition, ts automated classification makes keeping track of expenses easier, and its customized budgeting suggestions promote financial restraint.

Features

- Budget is Customizable

Mint users can customize their budgets according to their financial objectives. When users cross thresholds set in advance, this is the best budget app for couples, which notifies them and offers insights into their spending patterns and budgetary limit suggestions.

Importance

- Holistic Financial Overview

By combining data from several accounts, Mint provides consumers with a comprehensive picture of their financial condition. People can make educated decisions and understand their overall financial health.

- Time-Efficient Budgeting

Mint's real-time updates and automatic classification make budgeting more time-effective. By automating manually entering transactions and examining expenditure trends, users can free up more time to concentrate on financial planning for the future.

2) YNAB: Redefining Zero-Based Budgeting

Using a zero-based approach, You Need A Budget (YNAB) updates budgeting such that every dollar has a purpose. This organization places a strong emphasis on proactive financial planning by encouraging users to divide their income into many categories. Real-time tracking helps consumers develop responsible financial habits by providing them with insights into their spending patterns. This organization is a unique budgeting tool because of its easy-to-use layout, goal-setting capabilities, and extensive educational materials.

Features

- Bank Syncing and Importing Transactions

YNAB enables users to connect their credit cards and bank accounts quickly, simplifying transaction tracking. By automating the manual entering of transactions, this function makes sure that the budget is updated consistently.

- Debt Paydown Tools

It offers customers debt-specialized tools that help them address and strategically pay down their debts. These technologies provide a comprehensive approach to financial management by integrating debt payments into the overall budget.

Importance

- Goal-Oriented Budgeting

The goal-setting tools in YNAB give budgeting meaning. In order to feel motivated and accomplished, users can set goals and track their progress, which can help them finish projects like paying off credit card debt, saving for a trip, or setting up an emergency fund.

- Debt Awareness and Reduction:

YNAB helps users track their debt and make strategic plans for its repayment, making it an invaluable tool for anyone attempting to manage their finances. Due to the software's inclusion of debt payback throughout the whole budget, users are guaranteed to give it first priority above other financial obligations.

3) PocketGuard: Your Financial GPS

As an approachable budgeting tool, PocketGuard might be described as a "financial GPS." By providing customers with a real-time financial status report, PocketGuard aims to simplify the process of managing personal funds for users. Anyone who wishes to take control of their overall spending, savings, and financial health.

Features

- Budget Tracking and Analysis

With Pocket Guard, customers may establish budget limits for specific categories. Insights and visual representations of financial patterns are provided, and expenses are monitored against these budgets to help users see areas that could require improvements.

- Savings Goals

By enabling customers to establish precise financial targets, Pocket Guard helps goal-oriented savings. The program tracks progress and promotes disciplined saving for various goals, including emergency funds, significant purchases, and vacation savings.

Importance

- Efficiency in Budgeting

PocketGuard is an effective budgeting tool because of its automated transaction classification and budget-tracking features. Moreover, users can establish reasonable budget boundaries, rapidly identify spending patterns, and make changes on the road.

4) Personal Capital: Where Budgeting Meets Wealth Management

A complete platform for managing finances, Personal Capital combines wealth management functions with budgeting tools in a fluid manner. The website has gained increasing recognition since its introduction in 2009 for providing users with an all-encompassing view of their financial status. Personal Capital provides easy budgeting, retirement planning, net worth analysis, and advanced investment tracking.

Features

- Finance Dashboard

All-Inclusive: Personal Capital compiles information from many bank accounts, investment accounts, retirement accounts, and other financial accounts into one dashboard. With this comprehensive view, customers may quickly evaluate their entire financial situation.

- Retirement Planning Tools

Personal Capital provides goal-setting, forecasting, and optimization techniques and tools for retirement planning. Users can evaluate the amount of money they have saved for retirement, set retirement objectives, and get tailored guidance on getting there.

Importance

- Unified Platform for Wealth Management and Budgeting

One of Personal Capital's most incredible features is how wealth management and budgeting are easily integrated. With this integrated approach, customers may plan for long-term financial objectives like retirement or investment development and manage their daily finances.

5) Wally: Quick and Hassle-Free Expense Tracking

Wally is a smartphone budgeting application that makes financial management and spending tracking easier. Wally was created with a concentration on functionality and ease of use to simplify keeping track of expenses. It has consequently gained popularity among those seeking an easy and quick method of handling their funds.

Features

- Expense Insights and Analytics

Wally offers its consumers analytics and insights about their spending habits and behaviors. The app's analytics and statistics allow users to quickly detect trends, see their expenses visually, and make well-informed financial decisions.

Importance

- Budgeting Without Overwhelm

Wally's budgeting tools allow consumers to establish and keep track of their spending caps. This simplicity is beneficial for those who wish to maintain control over their finances but may feel overwhelmed by complex budgeting procedures.

- Motivation through Goal Tracking

Financial management gains motivation from Wally's goal-setting feature. Users are encouraged to maintain discipline in their spending habits and strive towards reaching their financial objectives by allowing them to create attainable goals and having Wally monitor their progress.

Conclusion

To sum up, an empower budget app is a really useful tool for financial well-being. All the best budgeting apps we mentioned on our list are valuable allies on the path to financial prosperity and stability, whether they are being used for tracking daily spending, creating financial objectives, or getting a thorough picture of one's economic situation.

Dividend Rate and Dividend Yield: What’s the Difference?

Different Features of S and P 500 Index Funds

Explore Our List Of Top 5 Budgeting Apps

Delta SkyMiles Gold AmEx

The global minimum tax rate has been supported by 130 countries including China

Best Retirement Communities for Active Adults

Chip Shortage May Dent Supplies of Credit and Debit Cards: A Complete Overview

What Does Chime Do?

What Are Best Endeavors?