Delta SkyMiles Gold AmEx

Dec 22, 2023 By Triston Martin

For frequent fliers of Delta Air Lines, the Delta SkyMiles® Gold American Express Card strikes all the right notes, with a $0 initial annual cost for the first year, followed by a $99 annual charge: It includes extra benefits in daily spending areas in addition to bonus rewards on travel, as well as free checked baggage and priority boarding. Additionally, the welcome offer is satisfactory.

Although the card does not provide entry to Delta Sky Club lounges (in the past, you could use it to buy a single-visit ticket for $29, but this is no longer the case), many Delta loyalists continue to hold onto it because of its other benefits. For example, the free checked-bag advantage easily balances the yearly charge for people who travel with baggage. This is true for both domestic and international travelers.

Basics

Card type: Airline.

Cost per year: Free of charge for the first year, after which it will cost $99.

Bonus offer: You will be awarded 40,000 extra miles after using your new card to make transactions totaling $2,000 during the first six months of having the card. There are certain restrictions.

APR: The continuing annual percentage rate (APR) ranges from 19.49% to 28.49%.

Rewards:

- You may earn two miles for every dollar spent on Delta purchases in restaurants anywhere in the world (including dine-in, takeaway, and delivery in the United States) and at supermarkets in the United States.

- Gain one additional mile for every other purchase that is qualifying.

- There are several conditions.

Benefits:

- You and up to eight other passengers flying on the same reservation are each eligible to get a free discount on your first checked bag.

- Boarding with more priority

- Enjoy a discount of 20% on some purchases made while on board.

- When you spend $10,000 in qualifying purchases during a calendar year, you will be rewarded with a $100 flight credit that may be used toward future travel with Delta.

Why You Might Want This Card

An offer of welcome, in addition to a reward for significant expenditure

The welcome bonus that comes with the Delta SkyMiles® Gold American Express Card might be enough to pay the cost of your next trip if you take advantage of it: You will be awarded 40,000 extra miles after using your new card to make transactions totaling $2,000 during the first six months of having the card. There are certain restrictions.

After spending $10,000 on Delta flights within a calendar year, you will be eligible for an additional $100 trip credit. There are several conditions. That is a low hurdle for you to jump if you want to use this card for major vacation purchases or day-to-day expenditures.

Good ongoing rewards

In addition to earning 2 miles for every dollar spent on Delta purchases, the Delta SkyMiles® Gold American Express Card allows cardholders to earn 2 miles per dollar spent at restaurants worldwide (including takeout and delivery in the United States), as well as at supermarkets in the United States. There are several conditions. This provides you an incentive to use the card for more than simply free checked luggage and travel, expanding the scope of its potential uses.

Priority boarding

If you have this card, you will also have the opportunity to board with the Main Cabin 1 boarding group. This will allow you early access to the desirable overhead bin space. This is a convenient bonus if you often travel with a big carry-on bag or a rolling suitcase. However, this does not guarantee that you will be the first passenger to board the aircraft. You will still have to board the aircraft after a few other categories, such as those traveling in first class or Delta Comfort+ and passengers holding certain elite status.

Why You Might Want A Different Card

No lounge access

Use a different card if you want access to airport lounges since that feature is only available on certain cards. The Bank of America® Premium Rewards® credit card may work well for you. It provides a statement credit of up to $100 per year for airline incidentals, which can be used for things like day passes to lounges as well as other travel expenses, and it provides a statement credit of up to $100 for an application to either Global Entry or TSA PreCheck.

Annual fee

You may consider looking at no-annual-fee general travel cards in addition to the $0 annual-fee option provided by Delta, the Delta SkyMiles® Blue American Express Card. These cards provide a wider variety of point redemption options.

For instance, the Bank of America® Travel Rewards credit card could be an excellent choice. It awards 1.5 points for every $1 spent on anything you buy. When redeemed for travel, each point is equivalent to a single penny. In addition, you will get a generous sign-up bonus and an initial offer of 0% interest on purchases.

Real Estate Agents Earning

Budgeting for Tomorrow: Reeves Implements Tax Increases to Fund UK Investments

What Exactly Is Order Flow Payment?

Best Retirement Communities for Active Adults

IOSCO’s global stablecoin program

A Guide to Reading Checks

What Is A High-Yield Savings Account?

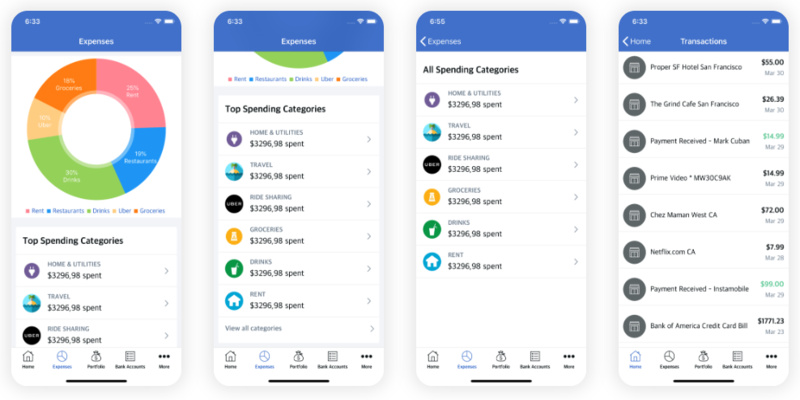

Explore Our List Of Top 5 Budgeting Apps

Understanding Mortgage Lending