Different Features of S and P 500 Index Funds

Feb 14, 2024 By Triston Martin

Because it contains companies from across all market sectors, it is often referred to as "the market," It is usually recognized as the greatest indicator of large-cap U.S. equities. In addition, it is frequently referred to as "the market." Microsoft Corporation (NASDAQ: MSFT), Apple Inc. (NASDAQ: AAPL), Amazon.com Inc. (NASDAQ: AMZN), Alphabet Inc. (NASDAQ: GOOGL), and Tesla Inc. are among the most important companies that make up the S&P 500.

Because of the S&P 500's widespread use as a proxy for the performance of the equity markets in the United States, many investment vehicles, including exchange-traded funds and mutual funds, have their stock holdings modeled after those of the index (ETFs). The second sort of fund is distinct from typical mutual funds in that it is traded on exchanges like regular stock and is posted there. Additionally, trades take place throughout the trading day. We will now examine the best S&P 500 index funds, beginning with the one with the lowest costs and moving on to the one with the most liquidity. The information shown here is current as of January 18, 2022.

Lowest Cost S&P 500 Index Fund: Fidelity 500 Index Fund (FXAIX)

A mutual fund is what FXAIX is. Because index-tracking funds will replicate the performance of the underlying index, the level of annual management fees is likely to be one of the most important factors, if not the most important one, in determining long-term returns.

- Expense Ratio: 0.015%

- 2021 Return: 28.69%

- Yield: 1.26%

- Assets Under Management: $399.36 billion

- Minimum Investment: $0

- Date of Establishment: February 17, 1988 (Share Class Inception Date: May 4, 2011)

- Fidelity is the issuing company.

Lowest Cost Runner Up: Schwab S&P 500 Index Fund (SWPPX)

The goal of the S&P 500 index fund offered by Schwab is to replicate the overall performance of the S&P 500 index. In most cases, the fund will invest at least 80% of its net assets (including, for this statement, any borrowings for investment purposes) in these stocks; however, the actual proportion of assets invested will normally be much greater. It will, in most cases, make an effort to imitate the index's performance by assigning the same weight to each stock that the index does.

- Expense Ratio: 0.02%

- 2021 Return: 28.66%

- Yield: 1.57%

- Assets Under Management: $71.38 billion

- Minimum Investment: $0

- Inception Date: May 19, 1997

- Charles Schwab, Inc. is the Issuing Company.

Runner-up in terms of lowest cost: Admiral Shares of the Vanguard 500 Index Fund (VFIAX)

Vanguard was the first company to create an index fund, and it continues to be the company with the most assets under Management. January 18, 2022, the Vanguard 500 Index Fund Admiral Shares contained about $753 billion. The investment goal is to achieve a return comparable to that of a benchmark index that evaluates the investment performance of equities with high market capitalizations. The fund utilizes an indexing investing strategy to replicate the performance of the Standard & Poor's 500 Index as closely as possible.

- Expense Ratio: 0.04%

- 2021 Return: 28.66%

- Yield: 1.33%

- Assets Under Management: $753.41 billion

- Minimum Investment: $3,000

- Date of Establishment: November 13, 2000

- Issuing Company: Vanguard

Lowest Cost Runner Up: State Street S&P 500 Index Fund Class N (SVSPX)

The product provided by State Street, which follows the S&P 500 Index in a manner that is similarly quite similar, is also in the running. However, putting money into this fund will need a minimum investment of $10,000.

- Expense Ratio: 0.16%

- 2021 Return: 28.54%

- Yield: 0.84%

- Assets Under Management: $1.71 billion

- Minimum Investment: $10,000

- Date of Inception: December 30, 1992

- State Street, the Issuing Corporation

Most Liquid S&P 500 Index Fund: SPDR S&P 500 ETF (SPY)

SPY is an exchange-traded (ETF), not a mutual fund, and it is not even the S&P 500 ETF with the lowest expense ratio. Despite this, the most liquid fund tracks the S&P 500. Liquidity is a measure of how simple it will be to trade an exchange-traded fund (ETF), and increased liquidity almost always results in reduced trading expenses. If you are interested in trading exchange-traded funds (ETFs) regularly, it is crucial to seek high liquidity funds to reduce your trading expenses. Trading costs are not a major problem for those wishing to own ETFs for an extended period.

- Expense Ratio: 0.09%

- 2021 Return: 28.52%

- Yield: 1.30%

- Assets Under Management: $455.22 billion

- Minimum Investment: $464.68

- January 22, 1993, is the date of conception.

- State Street, the Issuing Corporation

The opinions and approaches outlined in our material may not be appropriate for all investors. All of the comments, views, and analyses included within our material have been given as of the day the posting was made. Still, they are subject to change without prior notice since the market and economic situations are prone to fast change. The information is not meant to comprehensively examine every relevant fact about any nation, area, market, industry, Investment, or strategy.

What Exactly Are Pain and Suffering?

Comprehensive Crump Life Insurance Review: What You Need to Know

A Guide to Reading Checks

From Beans to Business: The Journey of Starting a Coffee Shop

See: How Credit Card Companies Determine Credit Limit?

What Exactly Is Order Flow Payment?

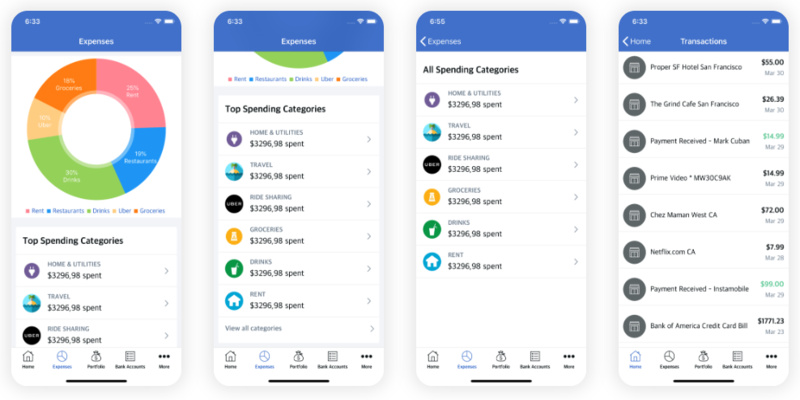

Explore Our List Of Top 5 Budgeting Apps

Good Paying Work From Home Jobs In 2023

S and P’s Downgrade of Azul: A Closer Look at the Airline's Debt and Financial Uncertainty