Analyzing the Best and Worst States for Retirement Living

Feb 05, 2024 By Triston Martin

The decision on where to retire is the most important one, as it determines your everyday life, finances, and quality of life in old age. This decision is not only about finding a beautiful place but also takes into consideration the cost of living, access to health care, and climate. The right retirement location can improve your quality of life because it provides the perfect combination of leisure, convenience, and value. This article provides a detailed analysis of several states, highlighting the ones that are the best and worst places to retire. We aim to provide insights that will guide you towards an informed, individualized decision for a satisfying retirement.

Factors Influencing Retirement Location Decisions

Cost of Living and Taxation

When planning for retirement, the cost of living is a critical factor. It determines how far your retirement savings will stretch. States with a lower cost of living allow for a more comfortable lifestyle on a fixed income. Taxation is equally important. Some states offer tax exemptions on pensions and Social Security income, while others do not. Additionally, property taxes, sales taxes, and other local taxes can significantly impact your financial health. Researching and comparing these costs across different states is crucial for a financially secure retirement.

Health Care and Accessibility

Access to quality health care is another major consideration. As health needs often increase with age, proximity to reputable hospitals and medical facilities becomes essential. States with a robust healthcare infrastructure, offering a range of medical services and specialists, are preferable. Additionally, consider the availability of long-term care facilities and in-home care services. Accessibility is not just about healthcare; it also pertains to the ease of getting around. Public transportation, walkable neighborhoods, and community services can greatly affect your quality of life, especially if you prefer not to drive.

Climate and Lifestyle Preferences

Climate plays a significant role in determining comfort and lifestyle in retirement. Some prefer warm, sunny climates, while others thrive in cooler temperatures. Apart from personal comfort, climate can also impact health conditions like arthritis or respiratory issues. Lifestyle preferences are equally vital. If you enjoy outdoor activities, consider states with ample recreational opportunities. Cultural offerings, community engagement, and proximity to family and friends should also be weighed. A state that aligns with your climate preferences and lifestyle aspirations can greatly enhance your enjoyment and satisfaction during retirement.

Analysis of the Best States to Retire In

Top 5 States for Retirement

The quintet that heads the retirement destination list is Florida, Pennsylvania, Arizona, South Carolina, and Colorado. Florida, being the land of sunny beaches and zero state income tax, is a top contender every time. Pennsylvania attracts with its long history and favorable taxation conditions for retirees. Arizona presents a distinctive desert environment with a dry and hot climate suitable for the lovers of perpetual sunshine.

What Makes These States Ideal?

These states stand out for their synergy of financial benefits, healthcare access, and lifestyle enrichment. They offer a cost-effective living environment with beneficial tax policies, crucial for stretching retirement savings. In terms of health, these states boast robust healthcare systems and facilities, ensuring peace of mind for retirees. Additionally, the diverse climates - from Florida's warm beaches to Colorado's mountainous regions - cater to various lifestyle preferences. Recreational activities, cultural experiences, and community engagement opportunities abound, providing a rich and fulfilling retirement experience in each of these locations.

The Other Side: Worst Retirement States

Bottom 5 States for Retirement

While some states shine as retirement paradises, others fall short due to various drawbacks. The bottom five states for retirement, based on various evaluations, are New York, New Mexico, Illinois, Mississippi, and Alaska. New York, despite its vibrant city life and cultural richness, is hindered by high living costs and taxes. New Mexico faces challenges with crime rates and healthcare quality. Illinois is marked by high taxation and a challenging fiscal environment. Mississippi, despite its low cost of living, struggles with healthcare quality and poverty rates. Alaska offers stunning natural beauty but is offset by extreme weather conditions and high living expenses.

Challenges in These Locations

These states present significant challenges that impact their desirability as retirement destinations. High living costs and taxation in states like New York and Illinois can strain retirement budgets. Healthcare quality, an essential factor for retirees, is a concern in states like Mississippi and New Mexico, potentially affecting the well-being and peace of mind of retirees. Additionally, safety concerns in some of these states can be a deterrent. Alaska’s geographic isolation and harsh climate pose challenges for those accustomed to more temperate environments and can lead to increased living expenses.

Retirement Location Analysis: Beyond the Rankings

Although rankings serve as a good reference point, the selection of a suitable retirement destination requires more than numerical scores. Individual preferences and personal needs have a deep impact on the decision process. Think about your lifestyle needs; are you looking for a fast-paced city, a peaceful beach community, or a tranquil rural setting? Temperature is another essential element; some love hot, sunny weather while others prefer the changing of seasons. Friends and family may also be a priority. Consider leisure activities and interests; is the place suitable for your favorite activities, be it golf, hiking, or cultural events? Healthcare services that are responsive to your particular health requirements should be available. Finally, to choose the perfect retirement destination you should consider your personal preferences and needs.

Conclusion

In the search for the ideal retirement destination, it is important to keep in mind that there is no universal solution. Other than rankings and numbers, personal preferences and specific requirements should serve as a basis for your choice. Through a careful consideration of the advantages and disadvantages of each possible destination, you can find a retirement location that provides the type of life, climate and facilities that speak to your dreams. At the end of the day, your happiness and satisfaction in your chosen location will be the gauge of your success.

Understanding Mortgage Lending

Comprehensive Crump Life Insurance Review: What You Need to Know

Gravestone Doji Pattern: Mastering This Powerful Trading Signal

Different Features of S and P 500 Index Funds

Boosted Sales Through Advertising Leads Clorox to Raise Profit Guidance

A Guide to Reading Checks

What Is A High-Yield Savings Account?

See: How Credit Card Companies Determine Credit Limit?

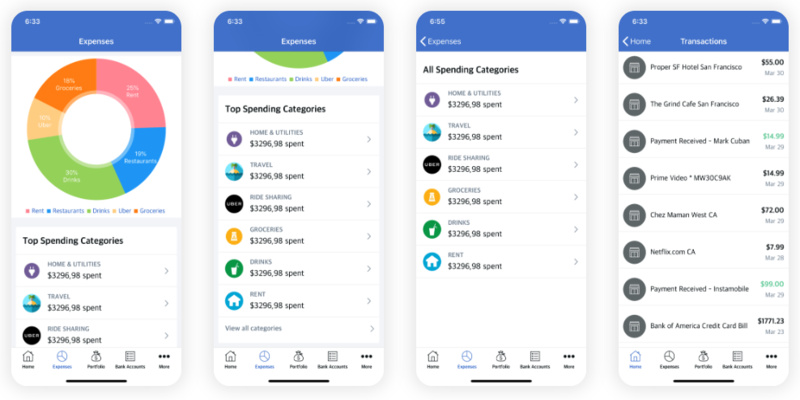

Explore Our List Of Top 5 Budgeting Apps